Pro-AV Business Index

August Bump: Improving Trends or Outlier?

Highlights

- With a score above 60, the AV sales index once again presents us with a question – are we witnessing an improving market situation or just a one-month outlier? The last time the index topped 60 was back in March of this year, with the last sustained period being in early 2024. Whether outlier or not, the longer-term trend graph shows definite improvement from late 2024 and early 2025 indicating accelerated growth as we enter the final phase of the year.

The general upward trend may reflect a bit more certainty relating to the tariff situation. The data does show a decline in the percentage of providers who report the political environment as a challenge, though inflation and rising costs remain an issue. This correlates with the broader inflation indicators, showing slight upticks in more recent readings. The US federal government’s preferred indicator of inflation, the core PCE, ticked up to 2.9% in July, the highest rating since February though only up 0.1 points from June. Still these factors did not appear to blunt the sales results reported by the AV channel in August.

On the employment side, the AV Employment Index continues to show a slow and steady result, in alignment with the broader job market. The index dipped only 0.2 points to 55.5, showing marked consistency from month to month. Broader employment data came in lower than expectations for August, demonstrating a limited amount of hiring. The same could be said of the AV space, which continues to show hiring at a low pace of growth. Some comments suggest staffing levels remain conservatively low as a hedge against potential slow-downs, putting some strain on existing resources.

International Outlook

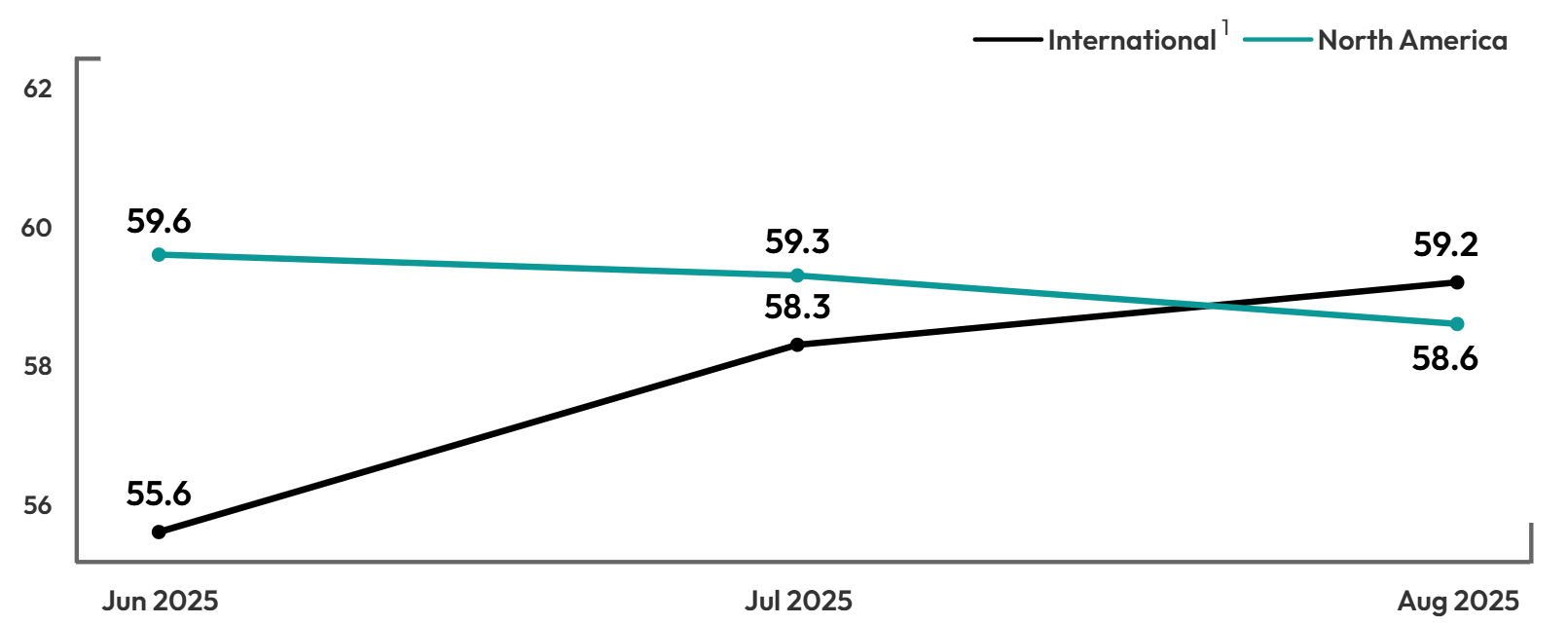

Similar to the July index results, non-US results were more positive. North American shows a continued decline in the rolling three-month average for billings of 0.7 points from last month, to 58.6, though the individual monthly scores show a bit of improvement in August. By comparison, the international billing results continued to improve, rising almost 3 points to 59.2, the strongest showing in more than a year. With some uptick in various economies around the world, this may be an indication of improvement for pro AV as well. The employment index shows similar shifts for both regions, though the international score rose a bit more. As mentioned above, while hiring may be picking up a bit, solution providers remain in a conservative mode around the globe

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. The August 2025 index is preliminary, based on the average of July and August 2025 and will be final with September 2025 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

UK recovering (slowly) Germany weak and North America weak against a strong rest of Europe.

Distributor, Europe

There is some uncertainty around major capital-construction projects, but the market seems to be adjusting to the reality of tariffs and pricing accordingly.

AV Provider, North America

No major changes, continuing to work on internal processes, pipeline seems steady.

Integrator, Asia-Pacific

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community between July 29, 2025 and August 5, 2025. A total of 224 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here